Quick Takeaways

- Sidechains are separate blockchains that securely link to a main blockchain.

- They let you run faster, cheaper transactions without overloading the main network.

- Security is handled by a cross-chain bridge that locks assets on the main chain and mints them on the sidechain.

- Each sidechain can pick its own consensus mechanism and smart‑contract platform.

- When you move assets back, the bridge burns the sidechain tokens and unlocks the originals.

What is a Sidechain?

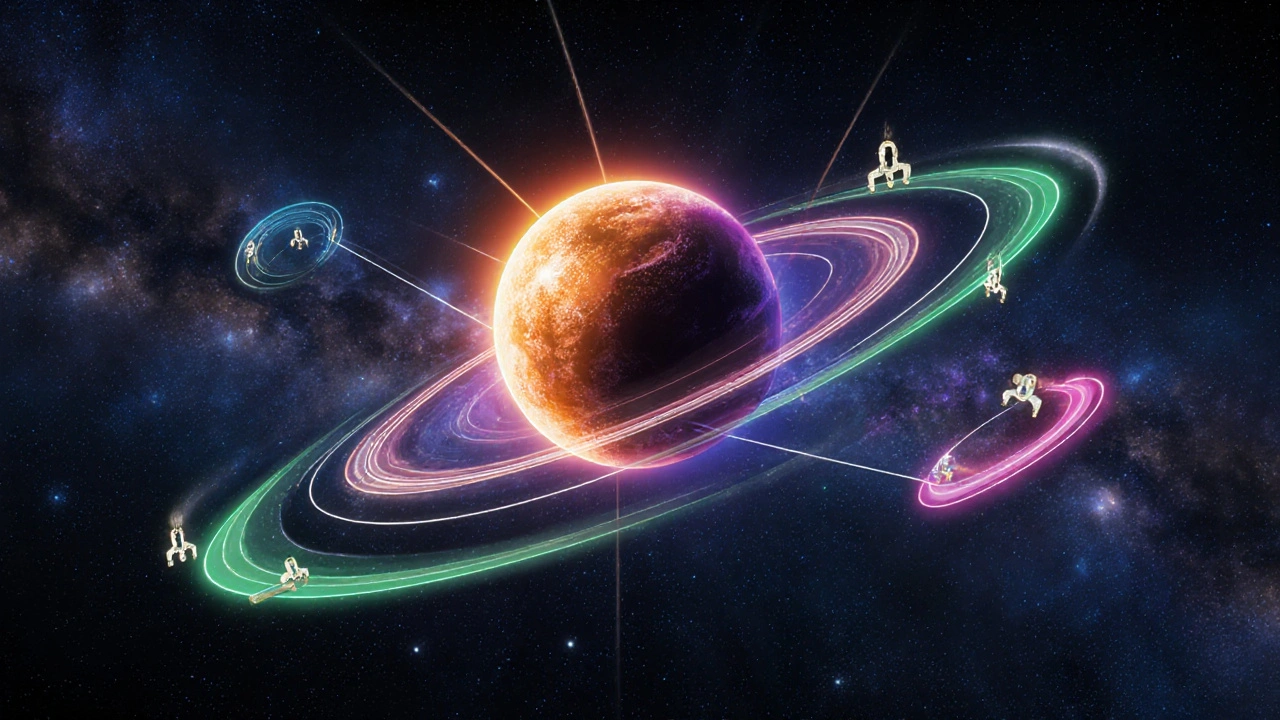

When building a Sidechain is a separate blockchain that runs in parallel to a primary network, often called a mainchain, it can process transactions independently while still being tied to the main network’s assets.

The idea is simple: you keep the security and decentralization of a big public chain-like Bitcoin or Ethereum-but you off‑load specific tasks to a faster, cheaper lane.

How Does a Sidechain Connect to Its Mainchain?

The link is made through a Cross‑chain bridge a set of smart contracts and relay nodes that lock assets on the mainchain and mint equivalent tokens on the sidechain. The bridge performs two critical actions:

- Locking: When you send Bitcoin to a sidechain, a special smart contract on the Bitcoin network (the mainchain) locks that amount forever.

- Minting: The bridge then creates a matching amount of "BTC‑sidechain" tokens on the sidechain, letting you spend them there.

When you want to move back, the bridge burns the sidechain tokens and releases the locked Bitcoin.

Consensus Mechanism: Why It Matters

Each sidechain can choose its own Consensus mechanism the algorithm that nodes use to agree on the next block, such as Proof‑of‑Authority, Proof‑of‑Stake, or Tendermint BFT. This freedom gives developers the ability to:

- Prioritize speed (e.g., finality in a few seconds).

- Reduce fees (by using fewer validators).

- Experiment with new features without risking the main network.

Because the sidechain’s security is separate, a bug or attack on the sidechain doesn’t automatically compromise the mainchain.

Smart Contracts on Sidechains

Most sidechains support Smart contracts self‑executing code that runs when predefined conditions are met. This enables complex DeFi apps, NFTs, or gaming logic to run at lower cost.

For example, the Polygon sidechain (built for Ethereum) lets developers deploy ERC‑20 tokens with gas fees that are a fraction of Ethereum’s mainnet cost.

Tokens and Asset Representation

The minted asset on a sidechain is often called a Token a digital representation of a value, such as a wrapped Bitcoin (WBTC) on a sidechain. Tokens can be:

- Wrapped native coins (e.g., wBTC on Ethereum sidechains).

- Utility tokens for sidechain governance.

- NFTs that move between chains via the bridge.

Because the bridge locks the original asset, the token’s total supply always mirrors the amount locked on the mainchain.

Real‑World Examples

Polygon (formerly Matic) runs a Proof‑of‑Stake sidechain that connects to Ethereum. Users enjoy sub‑second transaction finality and fees that are often under $0.01.

Liquid Network is a Bitcoin sidechain that enables faster Bitcoin transfers and confidential transactions, using a federation of trusted validators.

Rootstock (RSK) brings smart contract capability to Bitcoin by operating as a sidechain with its own virtual machine, but still anchored to Bitcoin’s security through merge‑mining.

Sidechain vs. Layer‑2: Quick Comparison

| Aspect | Sidechain | Layer‑2 (e.g., rollup) |

|---|---|---|

| Security model | Independent consensus; security relies on its own validators. | Shares security with the mainchain; uses fraud proofs or validity proofs. |

| Speed | Fast, because transaction finality is native to the sidechain. | Fast, but finality depends on mainchain confirmation windows. |

| Complexity | Higher, requires bridge infrastructure and token wrapping. | Lower bridge complexity; data posted to mainchain. |

| Typical use‑cases | Gaming, NFT marketplaces, and high‑throughput DeFi. | Payments, scaling simple transfers, and batch‑processing. |

Step‑by‑Step: Moving Assets to a Sidechain

- Choose a sidechain that fits your needs (e.g., Polygon for low fees).

- Connect a wallet that supports both the mainchain and the sidechain.

- Navigate to the bridge UI, select the asset you want to move, and enter the amount.

- The bridge contract locks the asset on the mainchain and emits a transaction receipt.

- After a short confirmation period, the sidechain mints the wrapped token to your address.

- Use the token on the sidechain for trading, staking, or NFT minting.

- When you’re done, initiate a “withdraw” on the bridge. The sidechain burns the wrapped token and the bridge releases the original asset back to your mainchain address.

Most bridges add a small fee (usually a few cents) to cover gas costs and validator incentives.

Common Pitfalls & How to Avoid Them

- Bridge centralization: Some bridges rely on a handful of validators. Pick bridges with audited code and transparent governance.

- Liquidity gaps: If the sidechain lacks enough liquidity, you may face slippage when swapping back to the mainchain. Use reputable bridges that partner with liquidity providers.

- Security mismatches: Treat sidechain assets as separate from the mainchain. Avoid storing large amounts on a sidechain that hasn’t proven its validator set.

- Network congestion: During spikes, bridge approvals can slow down. Plan withdrawals when gas prices are lower.

When Should You Use a Sidechain?

If you need any of the following, a sidechain is worth considering:

- High‑frequency trading or gaming where latency matters.

- Large‑scale NFT drops that would otherwise cost prohibitive gas.

- Experimentation with new consensus algorithms without endangering the main network.

- Lower transaction fees for everyday micro‑payments.

For simple value transfers where security is paramount, a Layer‑2 or direct mainnet transaction might still be the safest choice.

Future Outlook

Developers are building “interoperable sidechain ecosystems” where multiple sidechains can talk to each other without routing everything through the mainchain. Projects like Cosmos and Polkadot already provide hubs that connect many specialized chains, effectively turning sidechains into modular building blocks.

Expect richer tooling, standardized bridge protocols (e.g., IBC for Cosmos), and stronger audit frameworks over the next few years.

Frequently Asked Questions

What’s the difference between a sidechain and a layer‑2 solution?

A sidechain runs its own consensus and security, while a layer‑2 relies on the mainchain’s security and posts proofs or aggregated data back to it. Sidechains can be faster but require trusting a separate validator set.

Are my assets safe when I lock them on a bridge?

Safety depends on the bridge’s code quality and validator decentralization. Use bridges that are open‑source, audited, and have a track record of handling large volumes.

Can I move any token to a sidechain?

Only tokens that the bridge supports can be wrapped. Popular choices are Bitcoin, Ether, and selected ERC‑20 tokens. New bridges are adding support for more assets over time.

Do sidechains have the same transaction fees as the mainchain?

No. Sidechains often use cheaper consensus mechanisms, so fees can be orders of magnitude lower than on Bitcoin or Ethereum mainnets.

How do I choose the right sidechain for my project?

Consider three factors: (1) the consensus algorithm and its security model, (2) the ecosystem’s tooling and developer support, and (3) bridge reliability and fees. Test on a testnet before committing large amounts.